A significant chunk of taxpayers in India, nearly two-thirds, had no tax liability in the financial year 2024-25, according to government data. Out of approximately 84 million individuals who submitted their income tax returns by December 31, 2024, a staggering 55.8 million owed no tax. This highlights that only around one in three filers actually contributed to the tax pool, raising important questions about income distribution, exemptions, and the effectiveness of India's taxation policies.

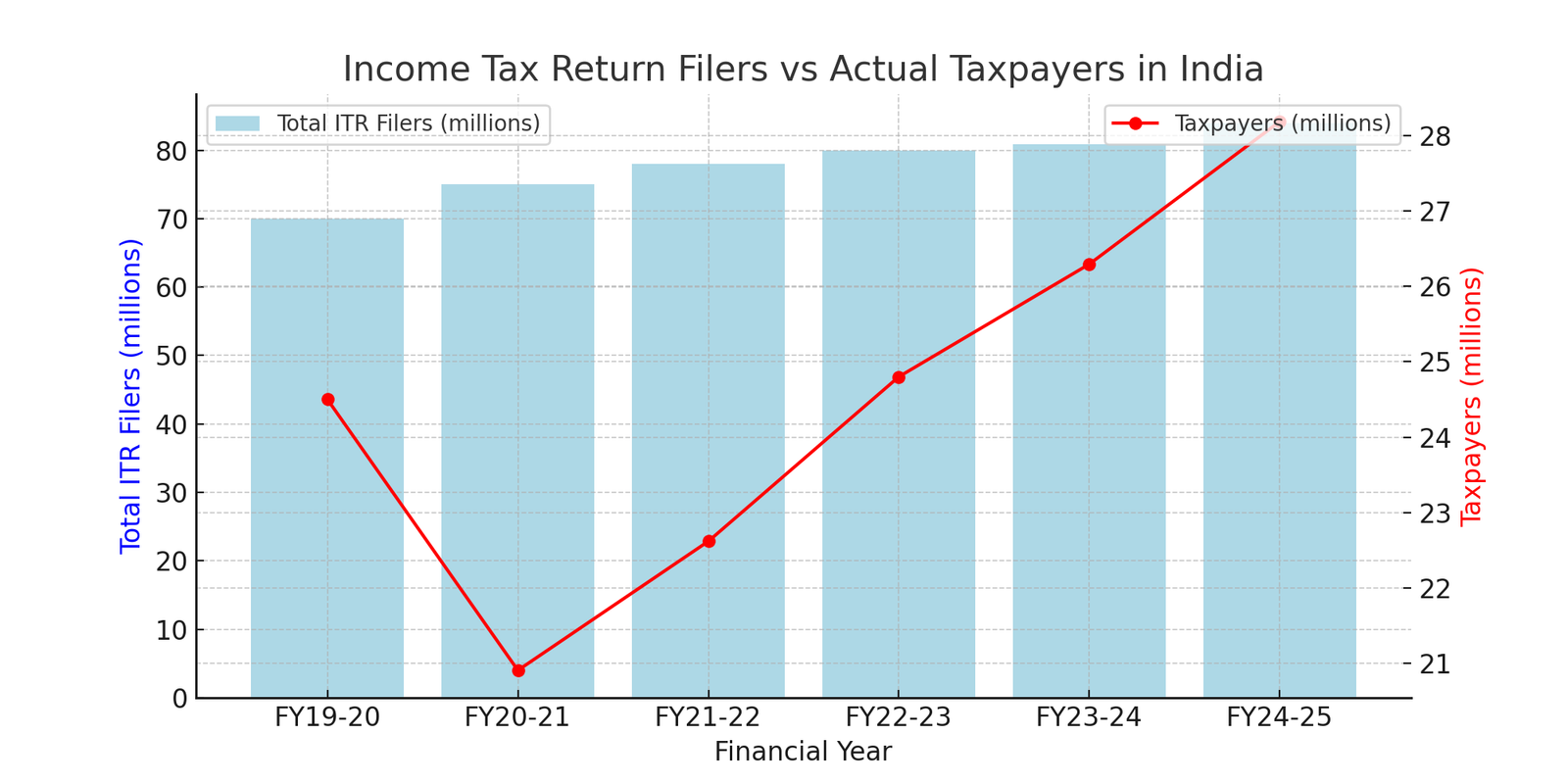

This pattern has persisted since 2020-21, with the proportion of taxpayers steadily increasing from 27.88% in FY21 to 33.55% in FY25. However, a striking contrast emerged when compared to FY19-20, where nearly half of the filers had tax liability, signalling a shift in taxpayer trends. The decline in tax-paying filers has been attributed to various factors, including changes in income tax slabs, enhanced exemptions, and improved compliance tracking mechanisms.

Officials attributed earlier high filing rates in FY21 and FY22 to the COVID-19 lockdown, which prompted an exceptional surge in return submissions. The pandemic-induced digital shift encouraged more individuals to file returns, often with no tax liability, to claim refunds or establish financial credibility. In the years that followed, compliance measures, digital nudges, and simplified refund procedures have contributed to an expansion in the tax base, albeit without a proportional rise in actual taxpayers.

The data also reflects an upward trend in tax return filings. In just the first nine months of FY25 (April 1 – December 31, 2024), nearly 83.97 million returns were filed. If this pace continues, the full-year figures could surpass the 80.9 million ITRs filed in FY24. The rise in filings is a positive indicator of increased participation in the formal economy, yet the relatively low proportion of taxpayers contributing to revenue remains a concern.

Despite the high filing numbers, only 28.17 million individuals effectively contributed to tax revenue. This suggests that a substantial number of individuals file ITRs without crossing the taxable income threshold, often benefiting from deductions under various sections of the Income Tax Act. Popular exemptions, including those for home loans, insurance premiums, and investments in tax-saving instruments, play a crucial role in reducing taxable income for a significant portion of the population.

Gross direct tax collection for the first nine months of FY25 was estimated at ₹20 lakh crore, with net revenue post-refunds standing at around ₹16 lakh crore. This aligns with the government's ongoing efforts to enhance tax compliance while ensuring that genuine taxpayers are not overburdened. The rise in tax revenue, despite a lower proportion of tax-liable individuals, indicates a concentration of tax payments among higher-income groups and corporate entities.

Additionally, a campaign by the Central Board of Direct Taxes (CBDT) played a crucial role in boosting compliance, persuading approximately 30,160 taxpayers to disclose foreign assets worth over ₹29,000 crore. Such initiatives highlight the government’s increasing reliance on data analytics and artificial intelligence to track undisclosed income and overseas financial holdings. Further monitoring through tax documentation like Form 26AS, high-value transaction reports, and the Annual Information Statement (AIS) aims to enhance voluntary compliance and track potential tax evasion.

The government's efforts to expand the tax net have also included stricter enforcement on businesses, professionals, and digital transactions. With e-commerce platforms and freelancers now falling under stricter tax scrutiny, authorities aim to bridge the gap between economic activity and tax collection. The introduction of pre-filled tax returns, seamless refund processing, and integration with financial institutions has also simplified compliance, encouraging individuals to remain within the tax system.

However, the disparity between ITR filers and actual taxpayers brings attention to the structural challenges of India’s tax ecosystem. Many individuals earning below the taxable threshold file returns for procedural benefits, such as availing loans, securing visas, or maintaining financial records. Moreover, the new tax regime introduced in recent years, which offers lower tax rates but fewer exemptions, has seen slow adoption, as taxpayers continue to favor traditional deduction-based schemes.

Another key issue is the narrow tax base. While corporate tax contributions remain significant, the government continues to focus on widening individual tax participation. Experts suggest that further simplification of tax laws, better incentives for compliance, and continued efforts to curb black money could help improve the overall effectiveness of India’s tax administration.

This evolving tax landscape underscores the government’s ongoing efforts to broaden the tax net while ensuring ease of filing for citizens. As India progresses toward greater economic formalization, future tax policies will likely aim at balancing growth incentives with equitable revenue generation.

The debate over the proportion of non-taxpaying filers raises larger questions about income distribution, economic inequality, and the sustainability of India's fiscal policies. Will future tax reforms address this imbalance? How can authorities encourage more individuals to contribute without imposing undue burdens? These are crucial discussions that will shape India's taxation system in the coming years.