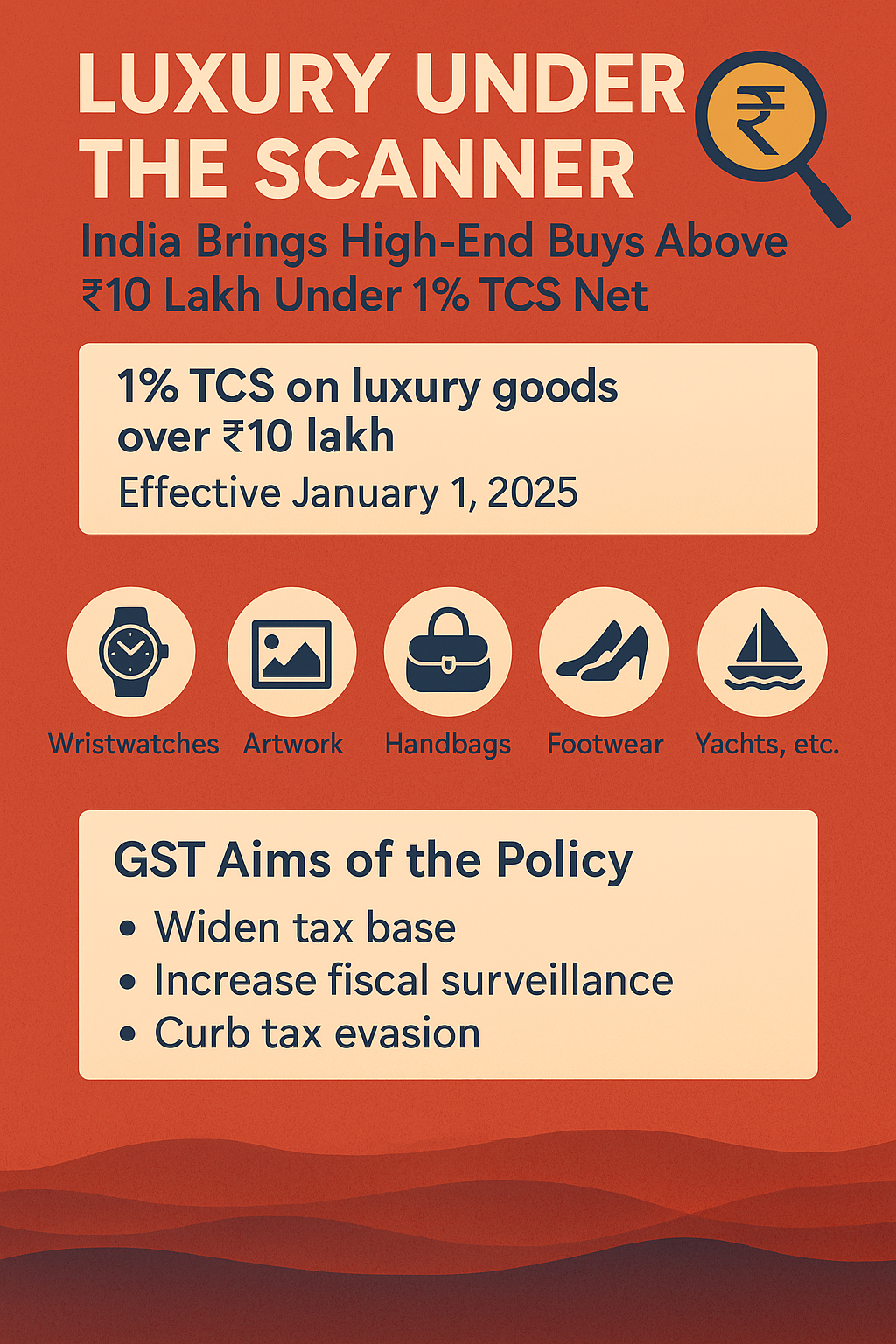

In a clear signal to widen the tax base and increase fiscal surveillance over high-value transactions, the Indian government has extended the scope of Tax Collected at Source (TCS) to include a broad range of luxury goods priced above ₹10 lakh. Effective April 22, 2025, purchases such as premium wristwatches, antique artworks, exclusive handbags, luxury footwear, collectible items, and even yachts or golf kits will now attract a 1% TCS rate at the point of sale.

This policy expansion, earlier applicable primarily to motor vehicles exceeding ₹10 lakh in value, is now being repurposed as a larger strategy to monitor wealth-driven consumption. The move is rooted in a two-pronged agenda—plugging tax evasion loopholes and aligning with international standards of consumption-linked taxation.

TCS: A Tool of Transparency, Not Just Revenue

Tax Collected at Source, originally introduced in the 1980s as an anti-evasion measure in sectors such as liquor, forest products, and scrap, has steadily evolved into a tool of financial accountability. By mandating sellers to deduct and deposit a portion of the transaction value to the government, TCS not only ensures early tax collection but also builds a paper trail of spending that can be audited later.

With this new extension, the tax authorities hope to bring India’s luxury economy—often perceived as informal and cash-driven—into sharper focus. Under the revised rule, any seller dealing in the notified goods must collect 1% of the transaction value (if above ₹10 lakh) from the buyer and deposit it with the Income Tax Department. The buyer, in turn, can adjust this amount against their total income tax liability while filing their annual return.

Tracking Luxury, Curbing Evasion

For the government, the larger objective is to bring more transparency into wealth-driven consumption patterns. High-end goods are not merely lifestyle choices—they are indicators of disposable income that often escape regular tax scrutiny. As a senior tax advisor puts it, “Luxury spending is a credible signal of income capacity. If someone can afford a ₹12 lakh handbag, it’s reasonable to assume they fall under a tax bracket that demands scrutiny.”

This regulation is expected to help tax authorities triangulate spending with declared income. Discrepancies between the two could serve as red flags for potential audits or deeper investigations.

A Gentle Nudge or a Compliance Headache?

While the government insists this is a nudge toward responsible spending and tax compliance, some industry insiders express concerns over operational hurdles. Luxury boutiques, which often cater to discreet high-net-worth clients, may find the mandatory TCS collection and disclosure process cumbersome.

Convincing customers to pay an additional tax upfront, even if refundable or adjustable later, could require significant effort—especially in sectors where brand experience and subtlety are paramount. Some fear this might drive such purchases to offshore destinations or unregulated channels.

However, many tax professionals believe this is a step in the right direction. “The global tax environment is shifting toward transparency and traceability. India cannot afford to be lax in how it monitors high-value discretionary spending,” said a partner at a leading tax consultancy.

What Buyers Should Know

For consumers, the 1% TCS is not a penalty or additional tax burden but a pre-paid advance toward their total income tax. It will appear in their Form 26AS and can be claimed while filing Income Tax Returns (ITR). However, it does mean that their luxury purchases will now be on record, available for tax authorities to review.

Conclusion

In a country where the luxury market is booming but often elusive, the extension of TCS to high-value goods is more than just a tax measure—it is a statement. It marks the government’s commitment to bring parity in tax contributions and ensure that those who spend big also contribute proportionately. For India’s affluent, the era of anonymous indulgence may be quietly closing.